UNSTUCK 016: The Quarterly Crit with Formo, Good Meat and Cheetos

Formo getting it right, a toss-up on Good Meat and a fail from PepsiCo.

The UNSTUCK crit (short for critique) is back for its third quarterly installment. Once again we review launch news from the consumer perspective (those who ultimately make or break a successful product launch) and capture marketing lessons to be learnt.

Three launches caught our attention this quarter, and sent our collective thumbs pointing 👍 and 👎.

Let’s dive in …

Formo 👍👍

Getting the right model in place

Full credit goes to Formo for their Frischhain, a cream cheese analogue made from koji protein, launch on several counts. Firstly, they understood the importance of the retailer as the gatekeeper to reach the consumer. Bringing Rewe, the second largest food retailer in Germany, on board as an investor as part of their Series B round means Rewe now has skin in the game. Indeed, where you’ll find Frischhain is in Rewe, along with two other store brands owned by Rewe. With the right support and placement in-store, they are setting themselves on the best possible track to gain a positive sales story and expand distribution from there. With more major retailers across markets establishing their own investment funds, this is a model other sustainable food brands can replicate.

Secondly, rather than waiting for everything to line up to launch their casein from precision fermentation (most likely regulatory approvals, marketing model, supply chain are all still in development), they have gone to market with a non-novel ingredient allowing them to test and learn their go-to-market strategies, whilst building brand awareness and trust. Importantly, they are proving commercial traction to investors which has resulted in completion of their Series B funding round.

Finally, the announcement of their funding alongside the Frischhain launch gave them a platform for wide media reach and an opportunity to rightfully show off their category leadership and what they’ve achieved with the aforementioned points.

Bravo Formo! Here’s hoping that the next iteration will have even stronger branding, messaging and standout on shelf, but who are we to nitpick.

Good Meat 3 👎👍

A homeopathic bait & switch or a bridge to the future?

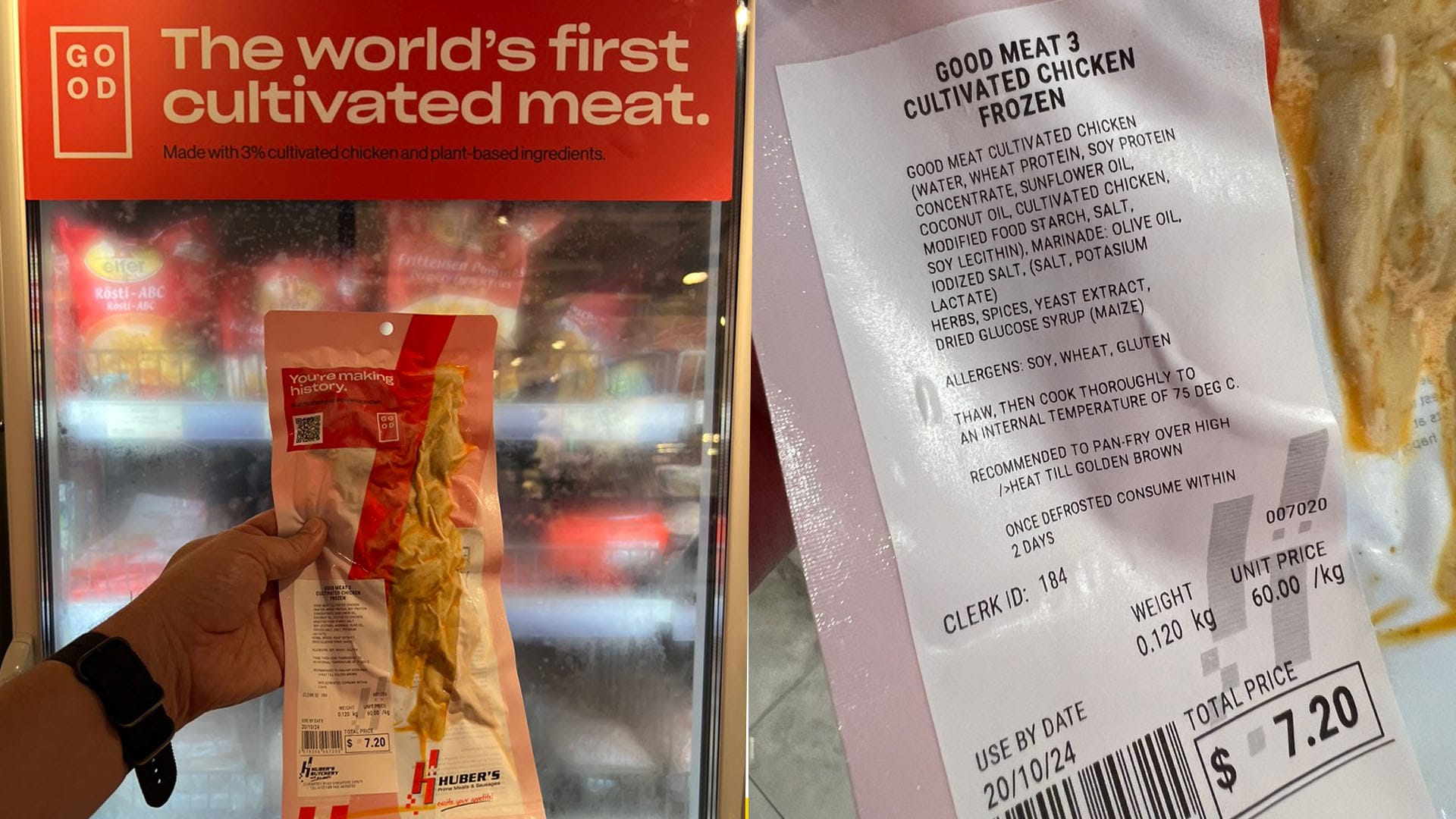

It is a truth universally acknowledged, that third sequels of things suck. Much like the third installments of The Godfather or Sharknado, Good Meat 3 chicken is letdown. Let’s start with the name itself. As a consumer you might expect that the “3” in Good Meat 3 refers to a new and improved version. Instead the 3 means you get 3% cultivated meat, down from 70% in previous versions. It’s a plant-based product that you can find on any shelf with a homeopathic sprinkling of chicken cells.

On the marketing front, the team at Good Meat seems to have given up as well. Gone are the elaborate activations of the 1880, Loo’s Hainanese Rice, and Madam Fan days that came with 3D VR glasses and hipster tote bags. The latest iteration stops at a fridge sticker, with the Good Food brand completely lost in an apologetic corner on the packaging itself, and the retailer taking all the credit. In terms of market buzz, the #GoodMeat3 hashtag created for sharing the experience has a grand total of 9 posts months after the launch. A clear 👎 from Zoran.

BUT if you continue on the theme of what Formo set out to do, it gets a 👍 in Jen’s book. It is thus far the only retail launch of cultivated meat in the world. Rather than waiting years for the marketing model (price, product, place and positioning) to work, moving forward with something to start learning and getting valuable consumer feedback, is far better than nothing. This launch allows Good Meat to build confidence with two groups critical to the future success of cultivated meat.

Firstly consumers, many of whom struggle with the concept of meat grown from cells, are likely more willing to try products that contain only a small percentage, starting the all-important journey to normalize cultivated meat in home kitchens. Secondly for investors in need of some confidence in the sector, a positive commercial step forward will make those boardroom conversations a whole lot easier.

Could they have done a better job on the branding? Yes. They need to be building their brand awareness and meaning, offering consumers a greater reason to buy than “the world’s first cultivated chicken". Nothing wrong with letting Huber’s Butchery lead on pack to leverage their established brand to gain trust, but they need to be building up Good Meat as well.

Vegan Cheetos 👎👎

A dominant brand getting the category drivers wrong

Much like Nutella from our previous quarterly crit, PepsiCo’s Cheetos is a dominant multi-billion dollar brand with nearly 90% market share in cheese snacks. Unlike Nutella, though, its approach to creating a plant-based version seems fundamentally confused.

In August this year a Canadian vegan instagrammer posted a render of a Vegan White Cheddar Cheetos variant. The alt-protein media got excited and amplified the story around the world. Apparently confirmed by PepsiCo as a test launch, the vegan variant of the 76-year-old brand uses its distinctive brand assets, including Chester Cheetah happily munching on a pale Cheeto.

But in a category driven by indulgence and flavor, positioning the product as primarily “Vegan” instantly pigeonholes the proposition as something meant for just the 2% of the Canadian population that identifies as such. Semiotically making the pack look white with faded cheetah spots suggests something was taken away from a brand that is typically rich and vibrant. Instead, doubling down on deliciousness and flavor that just happens to come in a vegan version could have made the idea appealing to a much bigger customer base. It’s no wonder the product seems to have gotten little or no traction.